Are you looking for ways to strengthen your financial security? A Gold IRA could be the answer you've been hunting for. Gold has historically acted as a strong safeguard against inflation and economic uncertainty. By investing your retirement savings into a Gold IRA, you can diversify your portfolio and potentially boost its value.

- Consider the advantages of a Gold IRA, such as: Protection against inflation and economic downturns.

- Likely for growth in value over time.

- Diversification within your retirement portfolio.

Consult with a qualified financial advisor to determine if a Gold IRA is the right decision for your individual needs and objectives.

Accessing Wealth Preservation: The Gold IRA Advantage

In today's unpredictable economic landscape, preserving your wealth is paramount. Traditional portfolio strategies may face challenges to safeguard purchasing power against inflation and market volatility. A Gold IRA, a specialized type of retirement plan, offers a compelling alternative for diversifying your assets and protecting your hard-earned savings.

- Gold, renowned for its historical value as a safe haven against economic turmoil, can significantly buffer the impact of inflation on your portfolio.

- Spreading investments across different asset classes, including gold, is a key principle of sound wealth management.

- A Gold IRA offers tax-deferred growth, allowing your portfolio to accumulate over time.

Consider partnering with a reputable financial advisor to explore if a Gold IRA is the right solution for your unique financial goals. Empower your financial well-being by exploring the potential of a Gold IRA.

Exploring the Gold IRA Landscape: A Step-by-Step Guide

Embarking on a journey to acquire precious metals through an IRA can be a daunting endeavor. To successfully navigate this investment avenue, a structured approach is essential. Let's outline a step-by-step guide to ease your Gold IRA journey.

- Firstly, undertake thorough due diligence on reputable gold IRA providers. Compare costs, programs, and client testimonials to select a trustworthy partner.

- Subsequently, evaluate your investment objectives. Consider factors such as risk tolerance and your long-term financial targets.

- After establishing your investment direction, migrate your existing retirement funds to the chosen Gold IRA account. This process typically demands coordinating with your current financial provider.

- {Finally|Ultimately|, purchase| the desired amount of gold supported by your IRA. Gold forms available include bars, each with unique characteristics and portfolio implications.

Periodically review your Gold IRA performance. Gold value trends can impact your investments, so it's crucial to stay aware and adapt your plan as {necessary|required.

Harnessing Precious Metals for Retirement: The Gold IRA Path

Securing a comfortable retirement necessitates careful planning and strategic investment decisions. As traditional retirement accounts face uncertainties in the market, many individuals are exploring to alternative asset classes like precious metals. A Gold IRA, or Individual Retirement Account, presents a compelling pathway for investors seeking to protect their portfolios and potentially augment long-term read more returns.

These accounts allow you to allocate in physical gold, silver, platinum, or palladium throughout a tax-advantaged retirement framework. Unlike traditional IRAs which primarily invest in stocks and bonds, a Gold IRA provides exposure to a tangible asset that has historically acted as a reserve of value during times of economic turmoil.

A Gold IRA can be a valuable addition to your overall retirement strategy, offering potential advantages such as:

* **Inflation Hedge:** Precious metals often climb in value during periods of inflation, potentially safeguarding the purchasing power of your retirement savings.

* **Portfolio Diversification:** Including gold to your portfolio can decrease overall risk by providing a correlation that is typically uncorrelated with traditional assets.

* **Tax Advantages:** Similar to other IRAs, contributions to a Gold IRA may be eligible for tax deductions, and earnings develop without immediate taxation.

Before investing in a Gold IRA, it's important to perform thorough research, understand the connected fees and regulations, and speak with a qualified financial advisor.

Maximize Your Retirement Portfolio with a Gold IRA

As you approach retirement, securing your financial future is paramount. A traditional portfolio often experiences volatility in the stock market, leading uncertainty and risk. To mitigate this vulnerability, explore adding a Gold IRA to your retirement strategy. A Gold IRA offers a tangible resource that historically acts as a hedge against inflation and market downturns. By allocating your portfolio with precious metals like gold, you can fortify your retirement nest egg.

- Augment Your Portfolio: Gold IRAs offer a way to counter the risks associated with traditional stock and bond investments.

- Preserve Purchasing Power: Gold has a track record of retaining its value during times of economic uncertainty.

- Safeguard Your Retirement Savings: A Gold IRA can yield a layer of protection for your retirement funds against market volatility.

Consult with a investment advisor to determine if a Gold IRA is the right incorporation to your unique retirement goals.

A Hedge Against Inflation and Market Volatility

In an era marked by financial instability, investors are diligently pursuing alternative avenues to safeguard their wealth. One such option gaining traction is the Gold IRA, a financial instrument that allows individuals to invest in physical gold as part of their holdings. Gold has historically been considered a reliable store during times of market volatility, and a Gold IRA can provide a degree of security against these risks.

- Asset Allocation: Adding gold to your investment strategy can reduce overall risk

- Value Preservation: Gold's value tends to rise during periods of inflation, preserving your purchasing power.

- Real Value: Unlike stocks, gold is a physical asset that you can possess.

Nevertheless, it's important to perform thorough research and consult with a experienced financial advisor before investing your funds in a Gold IRA. Understanding the potential drawbacks involved and matching your investment with your overall financial goals is paramount.

Alfonso Ribeiro Then & Now!

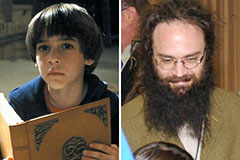

Alfonso Ribeiro Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!